Getting pre-approved for a Car Title Loan in Texas is key to fast cash access and a smooth process. Providing financial info, lenders assess eligibility with a pre-approval letter, offering loan amounts and repayment options. Loan renewals are available for eligible Texans, extending terms based on payments and balances. Proactive communication with lenders helps secure flexible solutions during challenges. Pre-approval simplifies extensions and consolidates debts, managing finances effectively using car title loans Texas.

In the bustling landscape of Texas, car title loans have emerged as a popular financial solution. Before diving into this option, understanding the pre-approval process and loan renewal policies is crucial. This article explores the intricacies of car title loans Texas pre-approval, outlining the steps involved and eligibility criteria. Additionally, we’ll guide you through the renewal process, offering insights on how to extend your loan term, ensuring a flexible and manageable borrowing experience.

- Understanding Car Title Loans Texas Pre-Approval Process

- Loan Renewal Policies and Eligibility Criteria

- How to Extend Your Car Title Loan in Texas

Understanding Car Title Loans Texas Pre-Approval Process

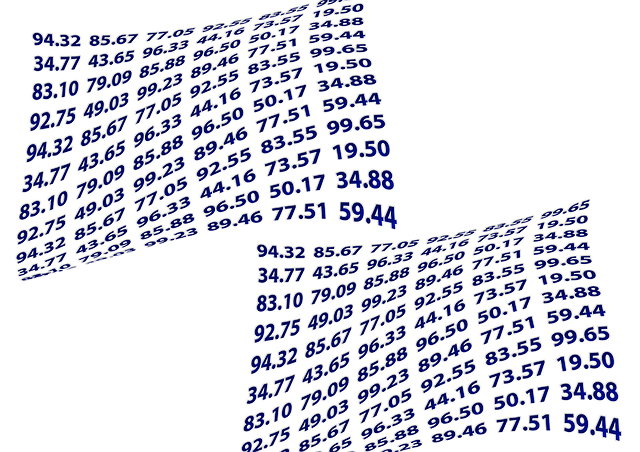

Getting pre-approved for a Car Title Loan in Texas is an essential step to ensure you access fast cash when you need it. The process involves providing relevant financial information, including your income, employment status, and vehicle details. Lenders will assess your eligibility based on these factors, offering a pre-approval letter that outlines the loan amount they’re willing to extend. This letter serves as a promise from the lender, assuring both parties of a smooth borrowing experience.

Pre-approval demonstrates your financial trustworthiness and simplifies the loan application process. Once you have this, you can confidently negotiate repayment options with multiple lenders, knowing your budget constraints. Remember, Car Title Loans are designed to provide fast cash solutions, but understanding your repayment obligations is crucial for managing your finances effectively.

Loan Renewal Policies and Eligibility Criteria

Many lenders in Texas offer loan renewal policies for car title loans, providing a safety net for borrowers who might encounter financial setbacks. This feature allows eligible borrowers to extend their loan terms, offering some relief from immediate repayment pressures. The process typically involves a simple application, where lenders will consider factors such as the remaining balance on the original loan and the borrower’s ability to make continued payments.

Eligibility for loan renewal often hinges on meeting specific criteria, including maintaining a clear title transfer and keeping up with regular repayments. Lenders may also conduct credit checks to assess the borrower’s financial health, though this doesn’t necessarily disqualify individuals from renewal. By adhering to these requirements, Texas residents can benefit from more flexible repayment terms, ensuring they retain control over their finances while managing their car title loans responsibly.

How to Extend Your Car Title Loan in Texas

In Texas, if you find yourself needing an extension on your car title loan due to unforeseen circumstances or unexpected delays, it’s important to understand that many lenders offer this service. The process typically involves contacting your lender in advance to discuss your situation and request a loan renewal. Lenders often provide flexible options, such as extended repayment periods or modified payment plans, especially if you’ve been making timely payments previously. This is where car title loans Texas pre-approval comes into play; having pre-approved ensures a smoother process during renewals.

One of the benefits of these loans is their potential for debt consolidation. If you have multiple debts with varying interest rates, a car title loan can offer a fixed-rate option, helping you manage your finances more effectively. By extending your loan and setting up manageable payment plans, you can focus on paying down other debts while keeping your car as collateral, providing peace of mind during challenging financial periods.

Car title loans Texas pre-approval and loan renewal policies are designed to provide flexibility and support for borrowers. By understanding these processes, you can make informed decisions about your short-term financing needs. If you find yourself needing more time to repay, exploring loan renewal options can help you maintain financial stability. Remember, responsible borrowing is key, and with the right approach, car title loans Texas can offer a convenient solution for accessing cash when it’s needed most.